Source: PropNex.com

The government has revised the SSD – by extending the holding period from 3 to 4 years, and raised SSD rates by 4 percentage-points – in a move to moderate the rising sub-sale numbers in the private residential market. We do not see this as a new cooling measure, but a move to revert to the previous SSD rules in a bid to tame sub-sales.

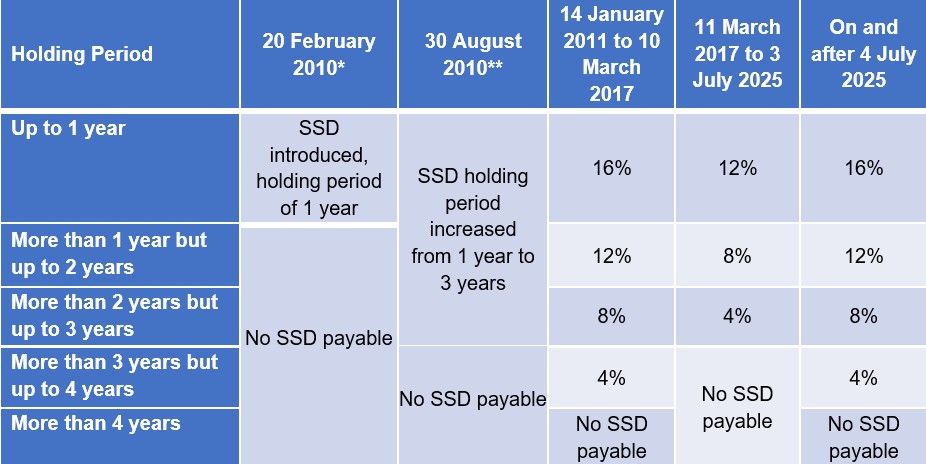

Table 1: Past changes to the SSD from 2010

Mr Ismail Gafoor, CEO of PropNex Realty said:

“The government has revised the SSD – by extending the holding period from 3 to 4 years, and raised SSD rates by 4 percentage-points – in a move to moderate the rising sub-sale numbers in the private residential market. We do not see this as a new cooling measure, but a move to revert to the previous SSD rules in a bid to tame sub-sales.

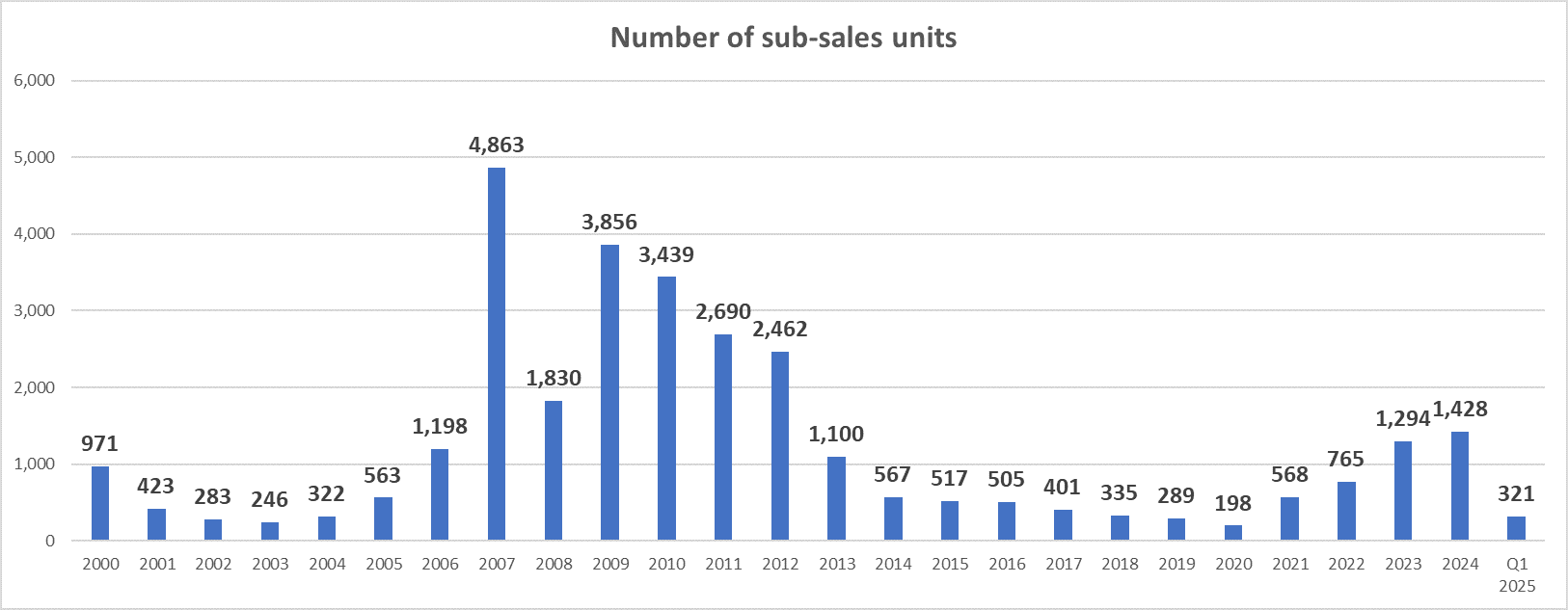

Sub-sales refer to units sold before the property has attained completion status, and that data point has at times been used as a proxy to gauge the extent of speculation activity. The number of sub-sales has trended upwards in recent years, rising consecutively for four years from 198 units in 2020 to 1,428 units in 2024 (see Chart 1). However, the sub-sales activity in the past years was still below the levels seen 2007 to 2012. We see the latest SSD revision as a pre-emptive move to moderate sub-sales and to curtail potential speculative interest, particularly with more private residential projects (ex. EC) slated to be launched for sale, and with the government planning to roll out more private housing units in various new neighbourhoods in the future.

Chart 1: Number of sub-sales transactions

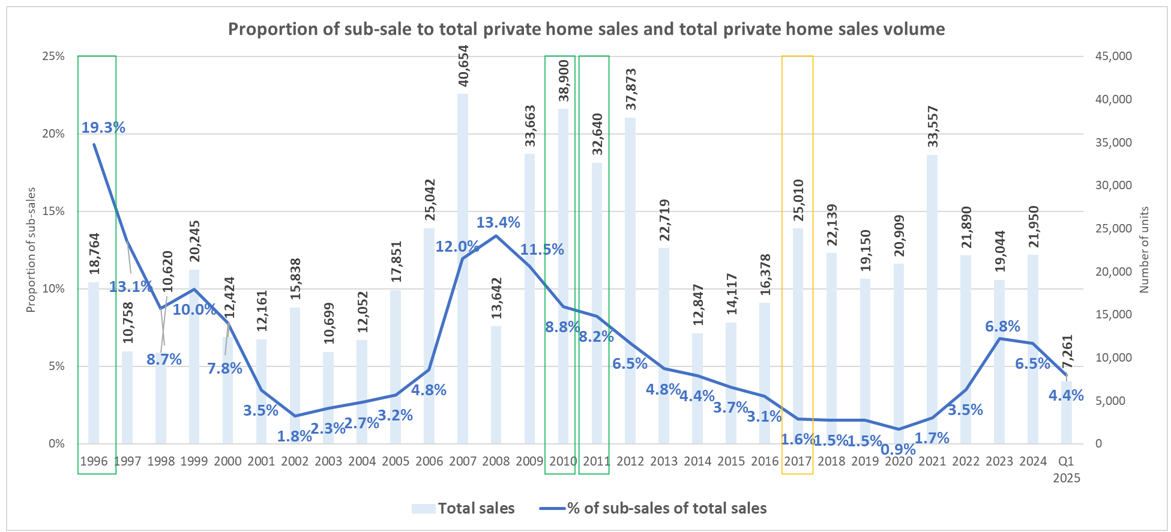

Chart 2: Proportion of sub-sales to total sales (%), and total sales (new, resale, sub-sale) volume

According to our analysis, the past SSD revisions in 2010 and 2011 appeared to have been effective in bringing down the proportion of sub-sales in the subsequent years (see Chart 2), leading to a relaxation of the SSD measure in 2017. Thereafter, sub-sales remained relatively measured before witnessing a steeper increase from 2022, after the COVID-19 pandemic. We think the increase in sub-sales between 2022 and 2024 was perhaps understandable, given the strong post-pandemic market rebound. From Q1 2020 to Q4 2024, the URA PPI rose by about 38% cumulatively, which may have potentially motivated some owners to sell the unit before it is completed.

Impact

In our view, this SSD revision is a calibrated measure, and not a broad-based market cooling move. We do not expect the latest SSD revision to have a significant impact on the housing market as most buyers today adopt a mid- to long-term view to their property purchase. In addition, we observe that the current buyer sentiment is not speculative in nature, with many prospective buyers either thinking of buying a unit for their own stay or to generate recurring rental income in the years to come.

Furthermore, private home prices have moderated recently, and we expect price growth could remain modest for the rest of the year. This may help to temper the level of motivation for owners to sell their property after a short holding period. Based on the flash estimates, the overall private residential property prices have risen by a cumulative 1.3% in the first half of 2025 (1H 2025) – slower than the 2.3% growth recorded in 1H 2024.

While it is too early to tell, it is possible that some investors may shift their attention to commercial properties, including strata offices and shophouses which are not subjected to the SSD nor the additional buyer’s stamp duty.”