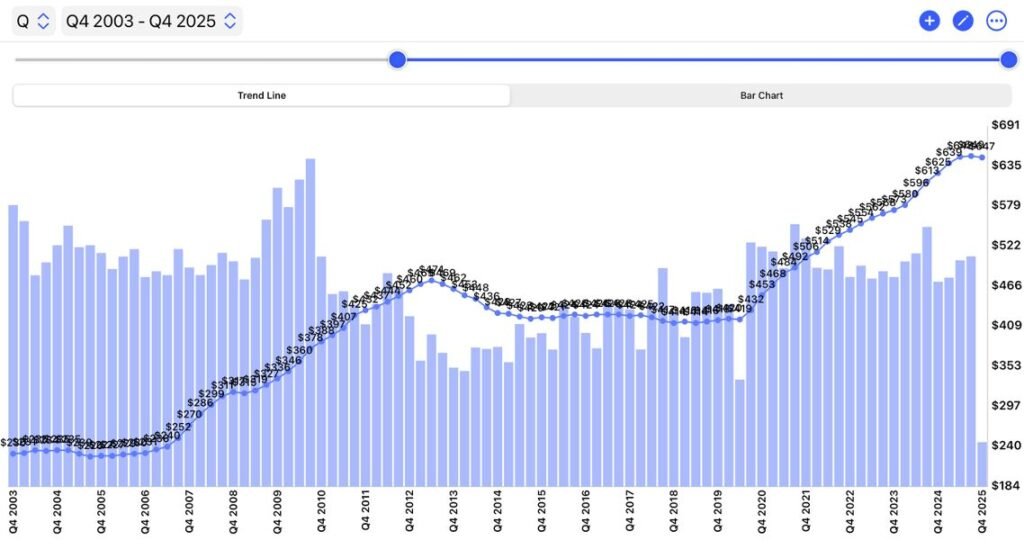

HDB resale volume just plunged 38%. Lowest since 2020.

If you’re a homeowner, this matters more than you think — because in property cycles, this is usually what happens right before prices start to move.

We’re already seeing early signs of price resistance in the resale market. Homes are still being listed at peak prices, but fewer buyers are stepping forward. That gap between expectations and reality is where markets usually turn.

So are we at the peak? I dare say, yes.

Volume Drops First, Prices Follow

In every property cycle, prices don’t fall first, volume does. What we’re seeing now is a classic tug-of-war. Sellers are holding on to record prices. Buyers are more cautious, more selective, and less willing to stretch. Transactions slow, not because demand disappeared, but because buyers are no longer convinced the value is there.

And that’s the key point. Singapore doesn’t suddenly have “no demand” for HDBs. The demand has simply shifted to where buyers feel they’re getting better value: the Built-To-Orders (BTOs).

More buyers today are choosing to wait for BTOs instead of getting a resale flat immediately.

And honestly, it’s not hard to see why.

Who wouldn’t want to be the first owner of a brand new home, with minimal wear and tear and better capital appreciation?

Why Buyers Are Choosing BTOs Instead

What’s different now is that today’s BTOs are not the same as 5–7 years ago.

The government has made several changes that quietly but significantly improved the BTO value proposition:

- Shorter waiting times of under 3 years

- Lower upfront cash and downpayment to ease affordability

- Flats are increasingly built before selection to reduce uncertainty

- A steady increase in BTO supply especially outside prime areas

Another key factor that’s often overlooked: the Selective En bloc Redevelopment Scheme (SERS) in Singapore has been paused. This removes the speculative upside for older flats. In the past, buyers were willing to pay premiums hoping for a future windfall. Without that expectation, price support for ageing resale flats weakens significantly.

At the same time, cooling measures and supply policies continue to keep resale prices in check. Together, these moves are quietly putting pressure on the resale market from multiple angles.

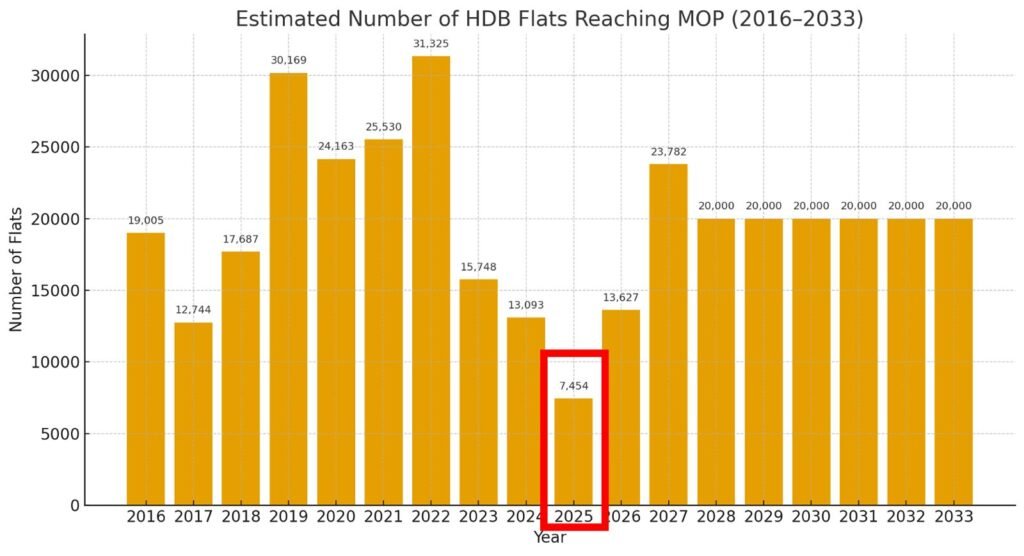

A Bigger Supply Wave Is Coming After 2026

From 2026 onwards, a large number of resale flats will reach their Minimum Occupation Period (MOP) and enter the resale market. That means more supply.

If supply increases while demand stays the same — or continues shifting elsewhere — what will happen to prices?

This doesn’t mean everyone must sell now. But it does mean that waiting without a plan carries risk. The biggest mistakes usually happen when homeowners assume yesterday’s prices will always be there tomorrow.

Whether you’re thinking about selling, upgrading, right-sizing, or reinvesting, the decisions you make in the next phase of the market matter far more than when prices were rising effortlessly.

Contact us below to chat!